What's New

The What's New page is updated bi-weekly to inform you about the latest releases and updates done within Corpay Cross-Border. Check back regularly for updates!

If you do not have access to a specific product or feature and would like more information, please contact your account representative for assistance or reach out to our support team.

February 06, 2026

Feature Updates

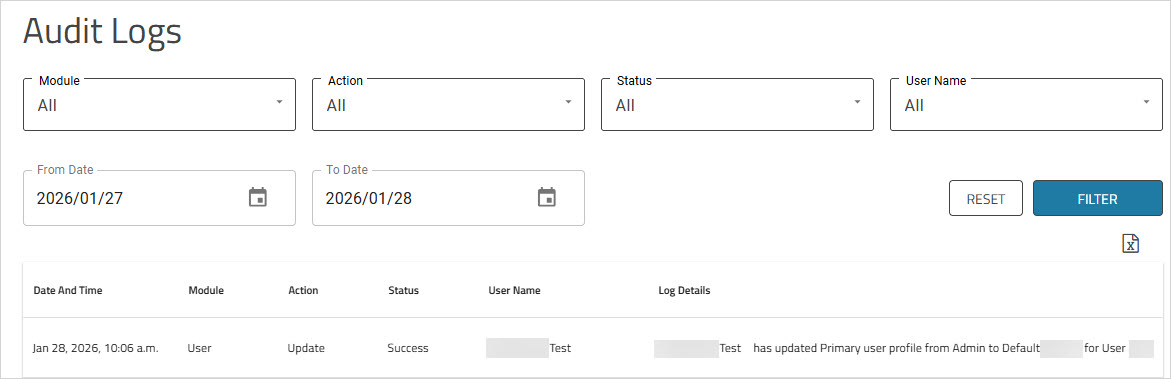

Audit Logs

We made the following updates to Audit Logs to improve audit reporting and records.

- Audit logs now track updates when a user profile is assigned to a new user or updated for an existing user in the Corpay Cross-Border User Information screen.

- Exported audit logs now include the Affiliate/Division information for all downstream clients, if applicable. For users without downstream clients, the export will display the client name and client code.

Learn more → Audit Logs

Previous Releases

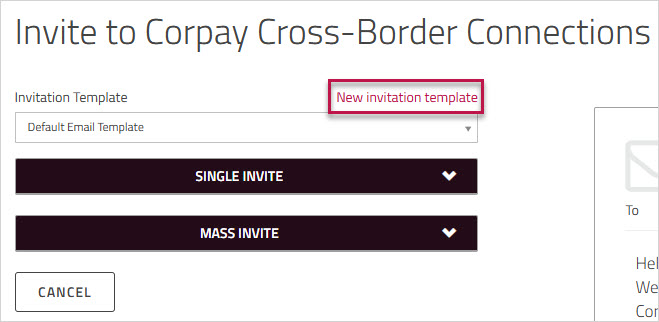

Corpay Cross-Border Connections

Non-admin users with the required permissions can now create and manage the Connections invitations email templates using the New invitation template link on the invite page. Previously, only Admin users could manage the email templates. Please contact your account representative to enable the invitation template link.

Learn more → Inviting a payee to Corpay Cross-Border Connections